Tax Planning for Retirees

2018 tax planning amounts to getting records together and deciding on who will do your taxes.

The records you will need are all your tax documents including:

- W2’s

- 1099’s

- brokerage statements

- quarterly payments

- and records of self employment income and expenses, etc.

If you are going to itemize or see if you should itemize, you’ll need:

- medical expense records

- charitable giving records

- property taxes receipt

- mortgage interest info

- gambling losses

But if you are over 65 you will need these to exceed $13600

- If Single, $19600

- If Head of Household, $25300

- If Married filing jointly or $26600 if both over 65.

Who will be doing the taxes?

- Yourself: Software like Turbo Tax or Taxact, free filing on line, paper forms, etc.

- Accounting firm: H&R Block, Liberty, etc

- AARP Taxaide: Free, meets here in library, Hours TBD

Tax planning for 2019

Most beneficial time to do planning that will reduce taxes is the period from retirement to age 70. After that most people have some required income paths that limit their options on how to take their income. Social Security and Required Minimum Distributions from IRA’s, 401k’s etc., and maybe other retirement plans.

Before reaching 70 you need to make decisions about which accounts to draw money from in order to minimize taxes now and later. Do you start Social Security? Pay off home? Draw on IRA? Start withdrawing from and annuity?

Types of income in retirement

- Part-time income: wages or self employment income Social Security

- Defined benefit retirement

- Interest (Taxable and Tax exempt)

- Dividends (Qualified and non Qualified)

- Capital Gains (Short term and Long term)

- Withdrawals from Retirement Accounts

- Savings or sales of property

- Annuities

Two tax breaks for old people.

- Increase in the standard deduction by $1,600 for single and head of household filers and $1,300 per person for Married filers who are over the age of 65.

- Qualified Charitable Distributions ( QCD) for filers over the age of 70.5 when paid directly from an IRA.

To reduce the your income tax you need to reduce your taxable income or structure your income so that you avoid the higher tax rates. Also your income level determines the percentage of your social security that will be taxed and your medicare premiums.

Definition of terms:

Adjusted gross income: Wages, interest, dividends, cap gains, retirement income, self employment income, taxable SS, gambling winnings, minus a few adjustments.

Modified Adjusted gross income: Adjusted gross income with the adjustments, non taxable portion of SS and tax exempt interest added in.

Taxable income: AGI minus itemized deductions or standard deduction.

Planning for 2019 and beyond

US NEWS: 7 ways to minimize tax

- Reduce your expenses.

- Pay off your mortgage before retiring.

- Minimize tax on your Social Security benefit.

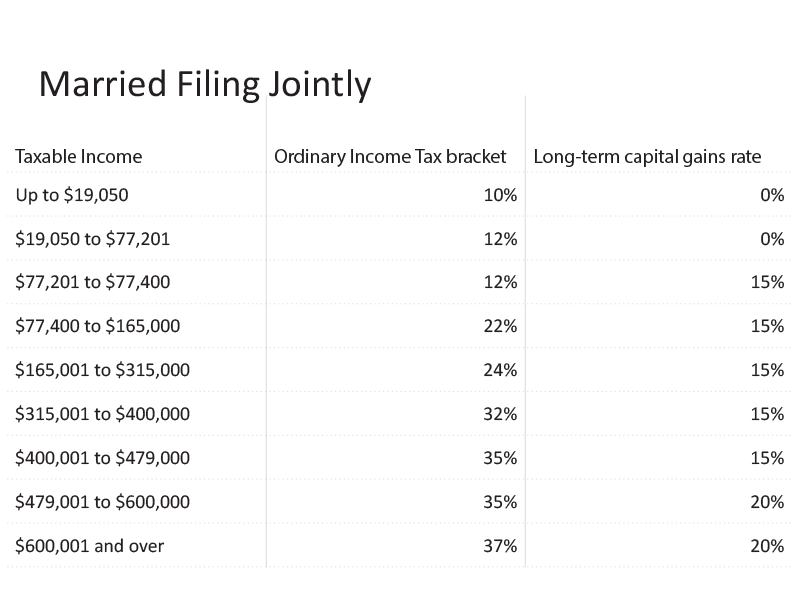

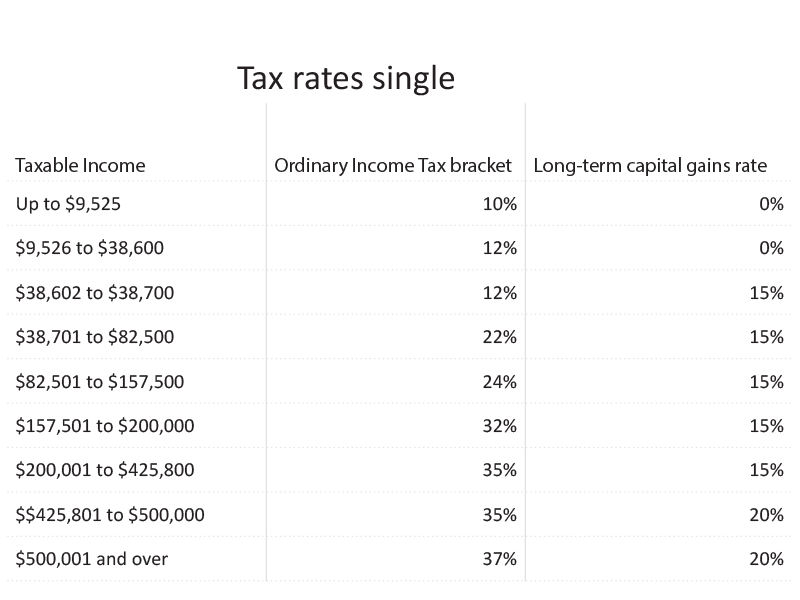

- Dividend income and long-term capital gains

- Roth IRA and Roth 401(k).

- Traditional IRA and 401(k) distributions.

- Diversify your after-retirement income.

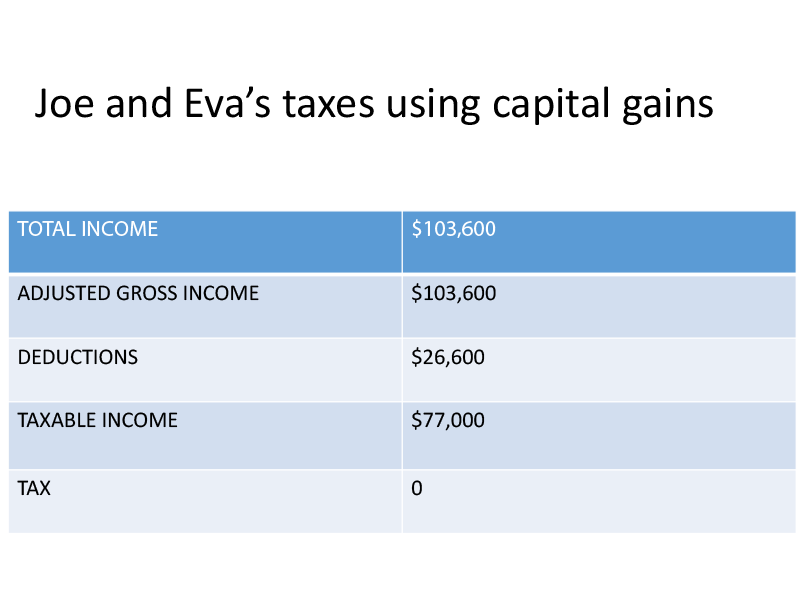

Example: Joe and Eva are married and want to pay off the $160,000 mortgage on their home and take a $20,000 cruise after they retire on Jan. 1 at age of 65. They estimate their living expenses for the year to be $40,000. He will receive $20,000 from a defined benefit plan and instead of starting SS he decides to pay for this by sell property for $200,000 of which $83,600 is capital gains. How much tax does he pay?

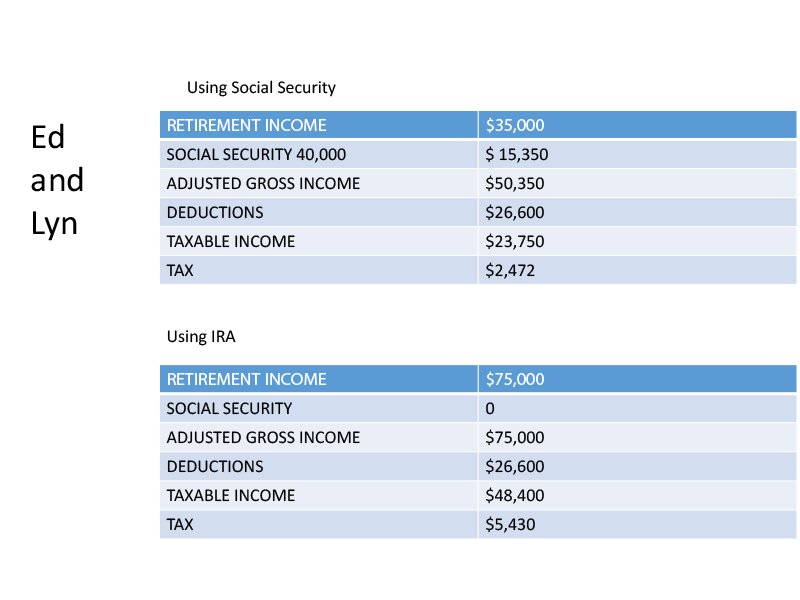

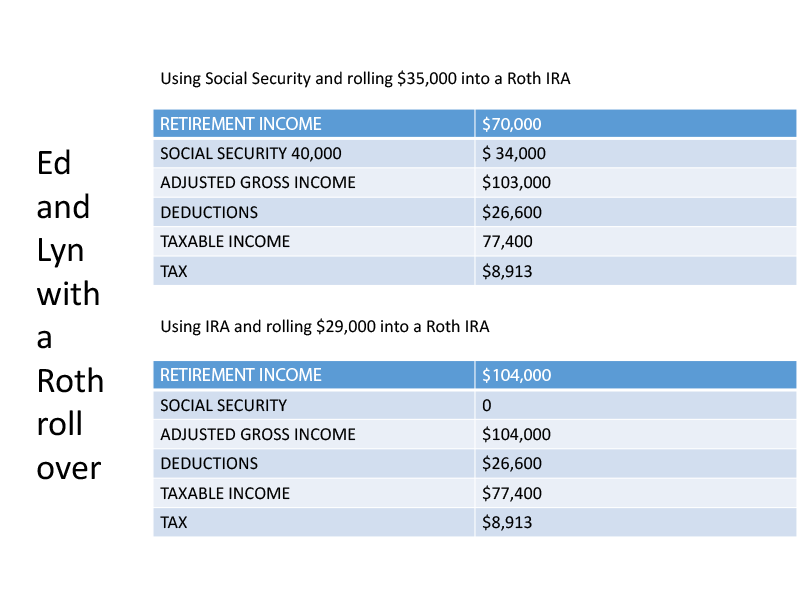

Example on decision between an IRA and SS: Ed and his wife Lyn both 67 need $75,000 to live on and only have the $35,000 income from a defined benefit plan. He needs to decide to start SS or draw on his $1,000,000 regular IRA. Their SS would pay $40,000.

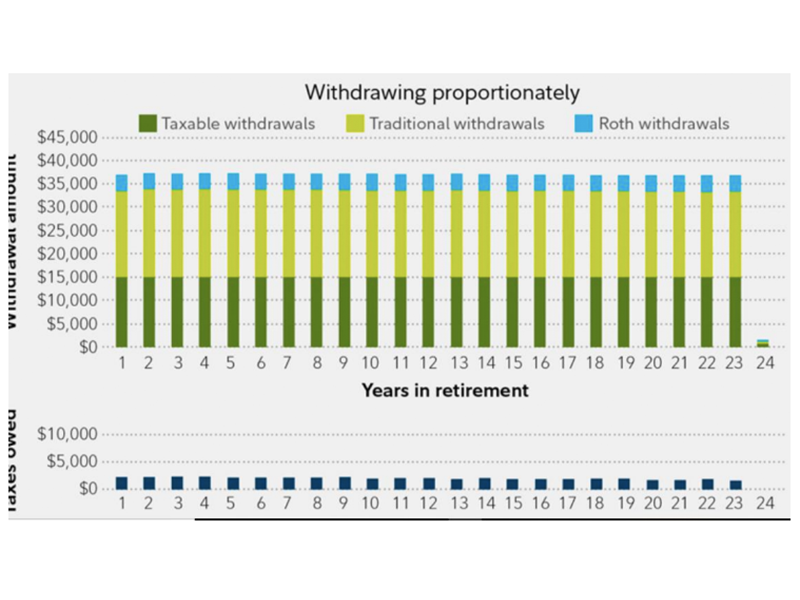

Example from Fidelity concerning taking money from one account at a time vs taking money from all accounts simultaneously.

Joe is 62 and single. He has $200,000 in CD’s and cash accounts, $250,000 in traditional 401(k) accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Let's assume a 5% annual return.

If Joe starts taking his $35,000 per year from his cash he will pay no tax for 7 years. He will then start taking money from his 401K’s and IRA’s. During the next 8 years he will pay $74,000 in taxes. He will finish by taking money from his Roth IRA and thus pay no tax. This will last him through year 22.

If Joe takes money proportionally from the 3 accounts then his money will last 23 years and he will only pay $46,000 in taxes even though he will have had to pay taxes every year. This is a savings of $28,000 in taxes or about 40%.

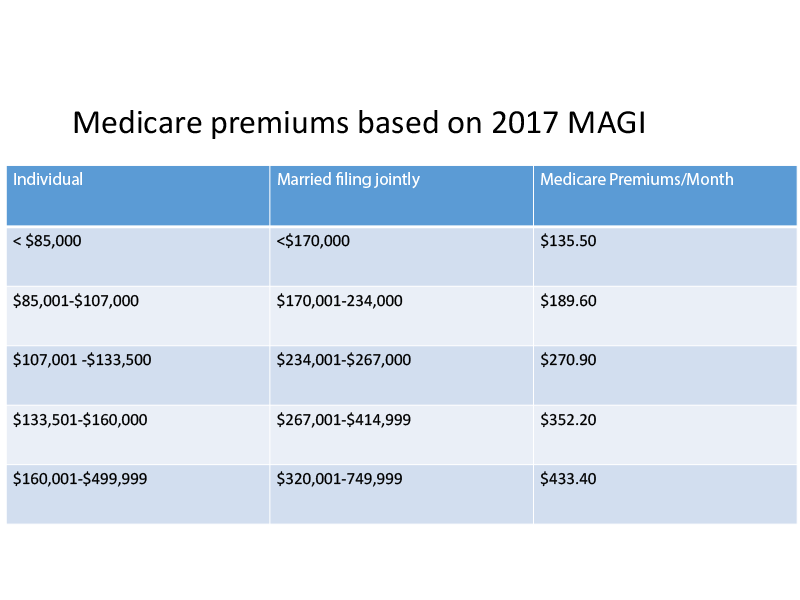

Medicare premiums based on 2017 MAGI

If you are a married couple with MAGI of $165,000. Since you son will inherit your IRA and he needs some money now. You know you can give gift him $20,000 with no gift tax so take out $20,000 out of the IRA to give to him. Besides income tax of $4,800 this year, in 2021 your medicare premiums will increase $54.10 each. So your medicare cost of 2021 will increase $1298.40.

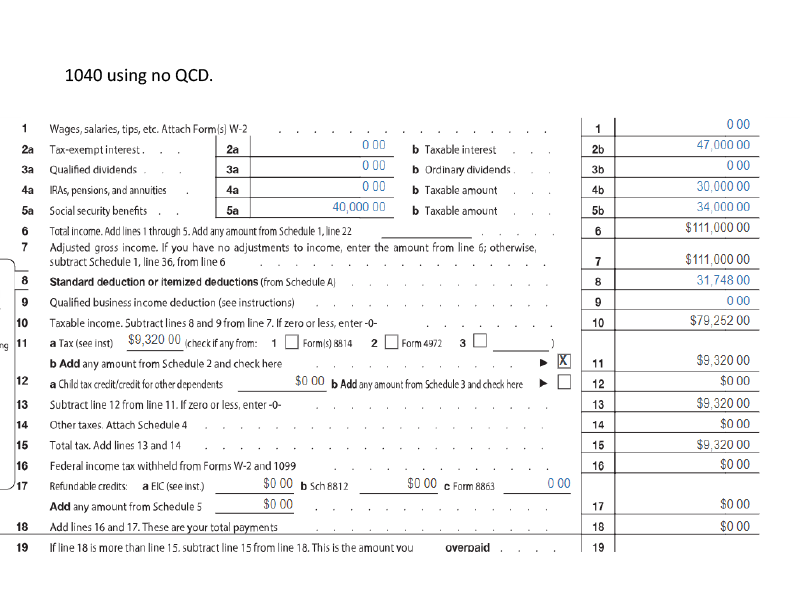

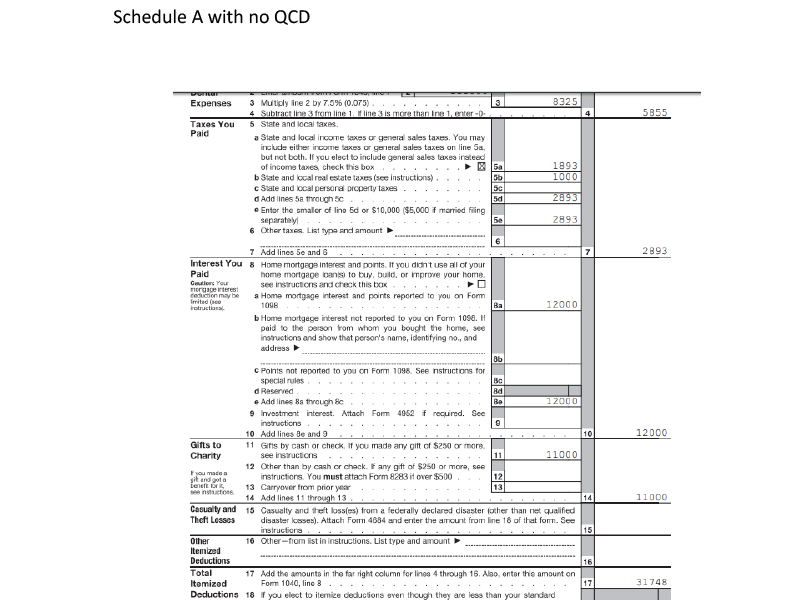

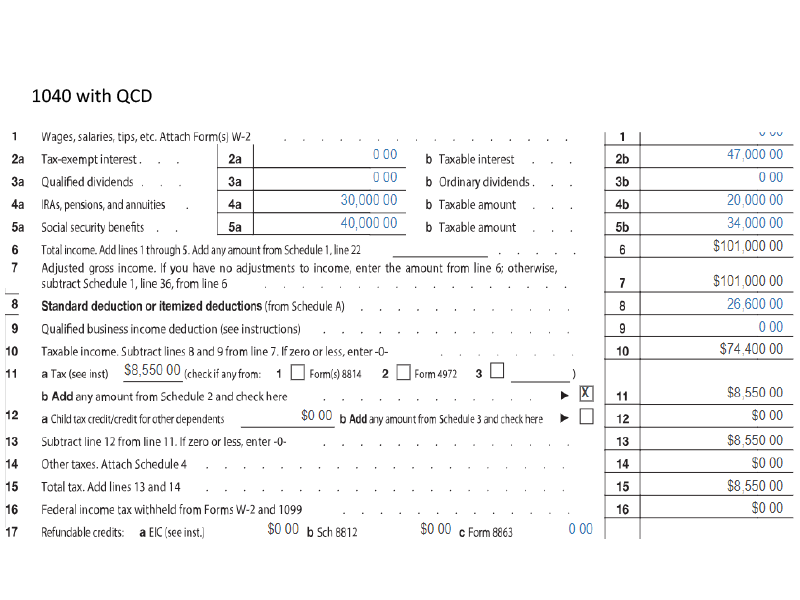

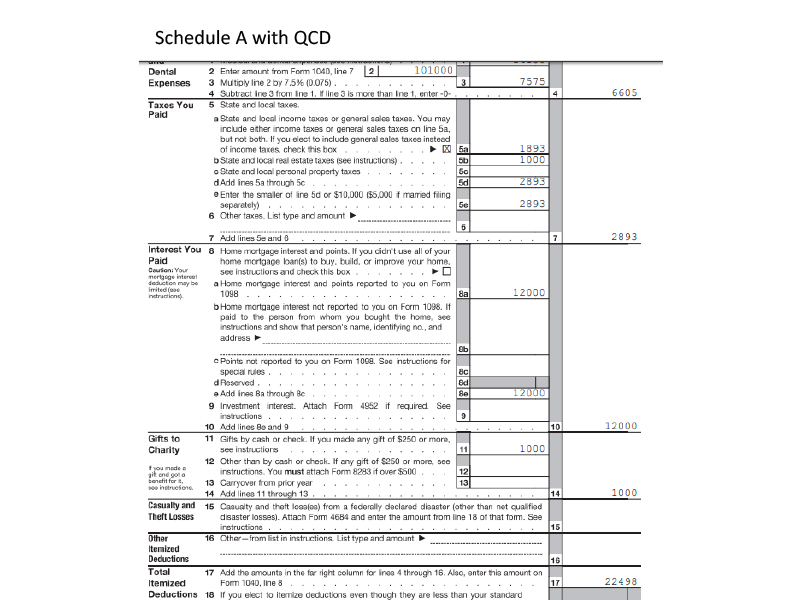

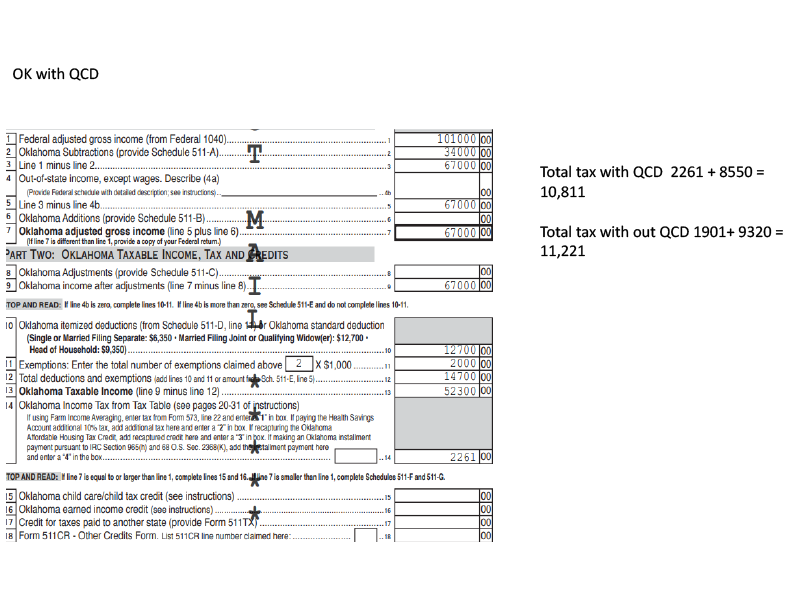

Example to show the use of QCD’s: You have taxable income of $47,000, an RMD of $30,000 and SS of $40,000. You also have medical deductions of $14,180, Sales tax of $1483 and property tax of $1000, Paid $12,000 interest on your home and Misc. gifts to charity of $1000 and a $10,000 donation to a 501c3.